Some Of Paypal Business Loan

Wiki Article

What Does Paypal Business Loan Mean?

Table of ContentsThe Best Guide To Paypal Business LoanLittle Known Facts About Paypal Business Loan.Some Known Details About Paypal Business Loan About Paypal Business Loan

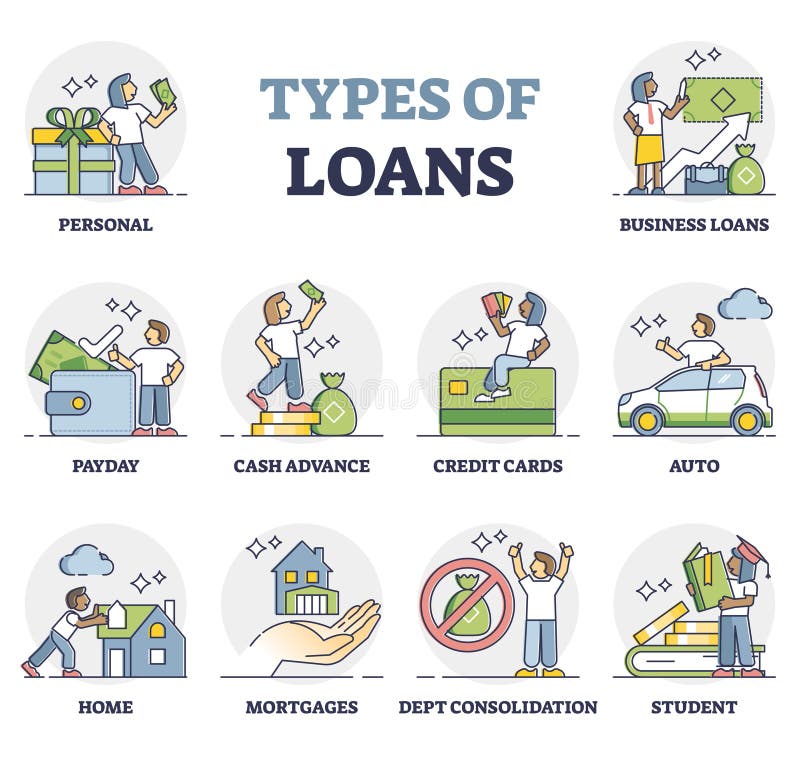

The SBA functions as the guarantor between the customer and the lender (PayPal Business Loan). In return, lending institutions offer their conditions, rate of interest caps as well as other criteria which call for approval from the SBA.The SBA offers various strategies and also you can choose any kind of plan which might suit your organization requirementfor example, buying stock, paying financial obligations or mortgages, increasing your company, and even for acquiring realty.SBA fundings do require an extensive application process, an individual credit report check, and collateral needs, so they aren't right for every person. When you hear words "car loan," a term lending from a significant financial institution is probably among the very first things that comes to mind. A term finance is defined as a lump amount, paid to a customer with an agreement to settle it over a collection time period, with rate of interest - PayPal Business Loan.

All you need to do is to remain within that credit report restriction. Utilize your credit report sensibly and also make timely regular monthly payments, as well as you can make use of the debt quantity as often times as you like while developing a favorable credit rating for your company. Entrepreneur that do not have security or a solid sufficient credit rating to get term car loans can depend on service debt cards for fast financing.

Financial debt spiral threat: It is simple for equilibriums and also rate of interest to stack up if you are unable to make your regular monthly payments in a timely manner. If you miss out on one settlement, the overdue equilibrium rolls over to the following repayment period, and you will be billed rate of interest on the new quantity, suggesting your following payment will certainly be higher.

Some Known Details About Paypal Business Loan

This can promptly develop an ever-increasing hole of financial debt as well as it's really tough to climb out without a huge infusion of money. Credit scores limits: All service bank card feature limitations, and staying within your limitation can occasionally verify to be a problem. You might get around this by making use of multiple cards, or you might be able to bargain higher restrictions in time.Unfortunately, when it concerns credit score cards, you're at the grace of the credit company. Can't use it for all kinds of payments: Local business proprietors that need fast funding to make pay-roll or pay rental fee generally can not use credit cards to make these particular kinds of payments. Based upon your individual credit history: Even most organization charge card are still linked to business owner's personal credit rating.

One advantage of a Seller Cash Advancement is that it is relatively very easy to acquire. One more benefit is that company owner can receive the cash within a couple of days. It is YOURURL.com not suitable for businesses which have few credit history card deals, since they will not have enough transaction quantity to obtain approved.: In hop over to here billing factoring, the lending institution purchases unsettled invoices from you and provides you many of the billing amount upfront.

Invoice factoring permits you to receive the cash that you need for your organization without waiting on your consumers to pay. The only problem with this sort of small service financing is that a majority of your organization earnings have to originate from slow paying invoices. You need to additionally have strong credit report history as well as a performance history of consistently-paying clients.

All about Paypal Business Loan

Let's take a thorough check out how Fundbox works in order to comprehend why it can be a good choice for your business finance. Here are some things to find out about Fundbox: Decision within hours: You can sign up online in secs and also obtain a credit decision in hrs. Once you make a decision to sign up, all you need to do is link your audit software or organization checking account with Fundbox.

If you pay early, then the later costs can obtain eliminated. As a little service proprietor, you know that there are a great deal of funding choices available. We wish this guide assists you start to pick which alternative makes the most sense for you. Consider the complying with information regarding your business before making your following move: Personal credit history rating: Take an appearance at your personal credit history.

The Best Strategy To Use For Paypal Business Loan

If your credit history is typical or low, then you will probably have to pay greater rate of interest or you might be rejected totally. Organization credit report: Ensure that your service has a good credit rating, as the loan providers will take your organization credit report right into consideration before accepting it for a financing.Business profits: Website The financing alternatives will vary depending on the means your company creates incomes. It made use of to be that a significant financial institution was one of your only choices for obtaining access to a service line of credit score, yet not any longer - PayPal Business Loan.

Report this wiki page